P2P (Peer-to-peer) crypto lending platforms provide a secure, transparent, and efficient way to borrow and lend funds without the need for intermediaries or traditional banking services. BTCpop is one such P2P crypto lending platform. As a reliable P2P platform, BTCpop has opened up financial opportunities for people who may have been excluded by traditional financial systems. Through BTCpop, an individual can seamlessly and safely attain a loan in the form of digital assets by eliminating the need for a middleman. Let’s learn more about this innovative platform in this BTCpop Review.

Introduction

Blockchain technology has completely transformed the world, revolutionizing various sectors (finance, supply chain, and even voting systems). In the past few years, Peer-to-Peer (P2P) crypto lending platforms have also emerged, challenging the traditional norms of borrowing and lending. Traditionally, we involve an intermediary or middleman, such as a bank or financial institution, whenever we need to borrow a loan. If you ever have obtained a loan traditionally, you may know how these intermediaries facilitate the process. Not only do they add layers of bureaucracy, delays, and additional costs, but they also waste a lot of time. However, with the advent of P2P crypto lending platforms, the need for intermediaries is significantly reduced.

(P2P crypto lending platforms are like fertile ground that leverage blockchain technology to create a decentralized marketplace where borrowers and lenders can directly transact with each other)

These innovative platforms not only speed up the financing process but also reduce costs and increase accessibility for users worldwide.

Reading this far, you might wonder which P2P crypto lending platform is the best. Some of you might have even guessed by looking at the title of this blog. Yes, you’re right—it is BTCpop.

Founded in 2014, BTCpop is one of the leading peer-to-peer crypto lending platforms. Besides offering seamless loan options, they also provide an opportunity to earn cryptocurrency online through staking and other methods.

In this BTCpop review blog post, we’ll discuss everything about this innovative P2P crypto lending platform—its services, benefits, reliability, and more valuable information. Throughout the blog, we’ll also examine whether it truly lives up to its reputation as a top P2P crypto lending market.

So, let’s jump straight into this blog post.

Understanding BTCpop & How You Can Use This

As the introduction mentions, BTCpop is one of the best peer-to-peer crypto lending platforms. Its services aren’t limited to only loans; BTCpop also provides facilities of investment pools, tied loans, earning opportunities & more. Based in the Marshall Island, BTCpop was founded in 2014.

The working of BTCpop is simple. It just challenges the norms of traditional financing processes. Unlike traditional financing processes, which include high transaction costs, lengthy approval processes, limited availability & lack of transparency, BTCpop is nothing alike. Moreover, you don’t even require a credit check to borrow a loan.

You might be wondering, if not like this, then on what basis can a user attain a loan?

Well, a user can borrow a loan based on two essential factors, which are given below:

- Borrower’s Collateral

- Their Reputation on the BTCpop website.

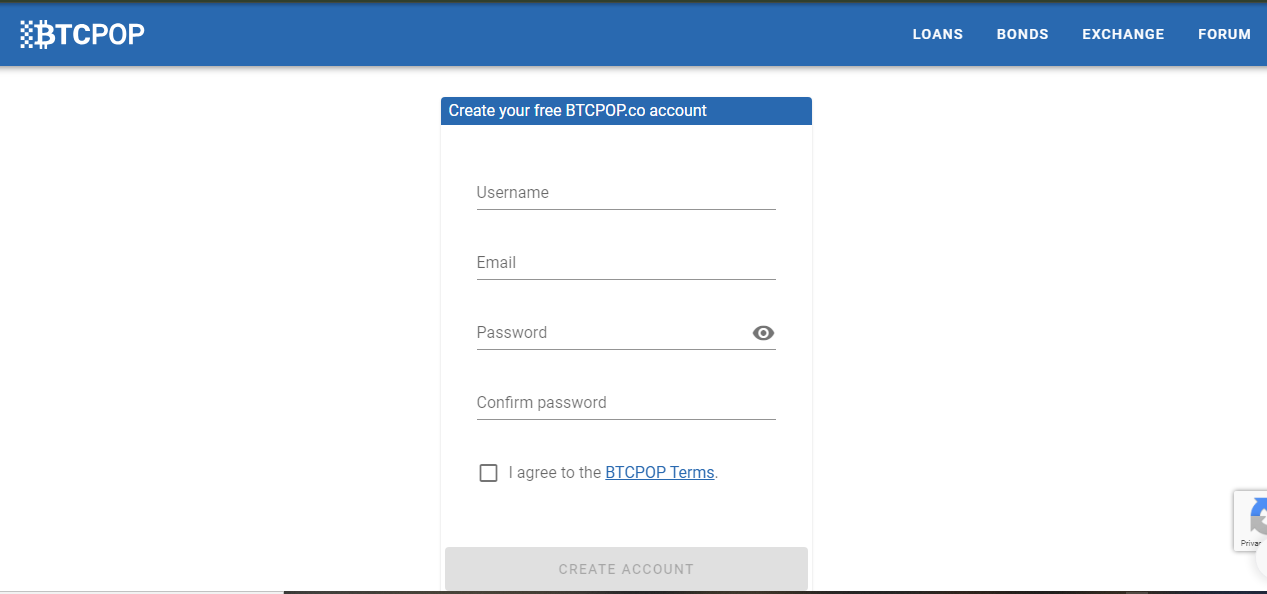

How to Register on BTCpop?

Excited to take advantage of BTCpop services? Then, you should definitely register for their website.

Sign up with the website, enter credentials such as password, username, and email address, and you’ll be eligible to leverage BTCpop services.

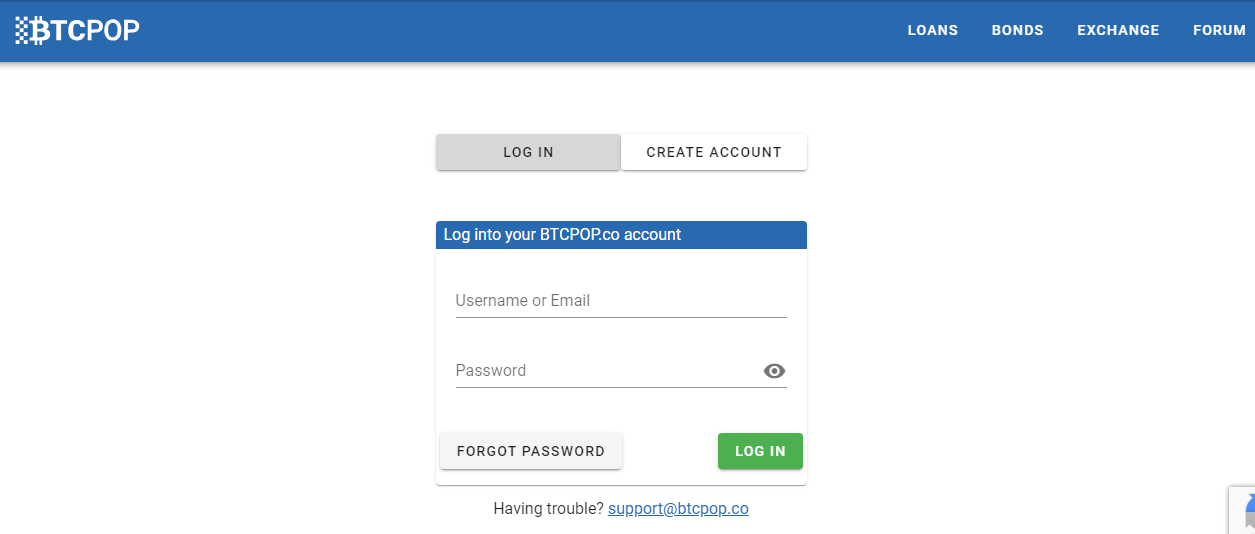

After creating an account, enter login.

Now, explore the BTCpop dashboard to leverage various services.

Analyzing the Different Types of Services of BTCpop

Today, BTCpop is among the trusted P2P (Peer-to-Peer) crypto lending platforms. The huge credit behind its high popularity goes to the type of service the platform provides. The primary types of services offered by BTCpop are given below.

1. Loans

Primarily, BTCpop is known for borrowing and lending seamless loans without the involvement of intermediaries. This innovative platform offers different types of loans, which include

Instant Laws

As the name ‘Instant’ suggests, these loans are designed for users who need quick access to Bitcoin without the hassle of lengthy approval processes. There’s one thing about these instant loans that you need to know – these loans are typically smaller in size and require no collateral. You can receive the funds almost within the same day after your application is approved.

Instant Collateral Loans

Unlike Instant Loans, these loans provide borrowers with fast access to funds by using their crypto field as collateral. Though the approval rate for these loans is quick, the borrower must deposit a certain amount of crypto as a security.

Custom Personal Loan

If you ever have obtained a loan from a reputable bank, you would see how they prioritize individuals who have good to excellent credit scores.

(A credit score is a numerical representation of an individual’s creditworthiness. It is calculated based on several factors, including a person’s credit history, the total level of debt, & more. Typically, a good credit score ranges between 700 and 749, while an excellent one lies between 750 and 850.)

You can also find similar types of loans on BTCpop. Though BTCpop as a platform propagates the concept of hassle-free and non-collateral loans, you can also find collateral-required loans since it welcomes borrowers of all kinds.

It should be noted that the approval process for obtaining a custom personal loan on BTCpop may take longer due to collateral involvement.

Custom Business Loans

You might have gotten an idea about the meaning of these loans by looking at the heading alone. Custom business loans are particularly designed for entrepreneurs and businesses seeking capital for growth, operations, or other business-related expenses. Unlike custom personal loans, these loans do not require collateral. However, obtaining such loans is largely based on the business’s credibility and the borrower’s business plan.

2. IPO and Community-based Funding

As a crypto enthusiast, many of you might be introduced to IPOs.

An IPO, or Initial Public Offering, is like a public launch event in which a particular company sells its shares to investors. This whole process of selling shares of stock is known as an Initial Public Offering (IPO). According to experts, a company should always choose a reliable platform to facilitate a successful IPO.

There’s no other ideal platform for IPOs than BTCpop itself. This innovative platform allows entrepreneurs to create an IPO and seek community funding. Most investors participate in these IPOs to become part of emerging and potentially successful startups. By buying a few pennies of shares, they can earn big profits in the future.

3. Cryptocurrency Exchange Options

Besides loan and IPO services, the BTCpop platform also provides cryptocurrency exchange options. You can exchange or trade a wide range of cryptocurrencies. In total, the platform has 184 different cryptocurrencies available. This number fluctuates as the platform adds or delists digital coins as per its guidelines.

As of now, there are five categories, namely BTC (Bitcoin), ETH (Ethereum), USDT (US Dollar Tokens), USD (Stands for Tether), and DAI (dai). In each category, there is a wide range of tokens present. You can trade different types of tokens by exchanging them in other currencies.

Unlike its competitors, like SmartFi, BTCpop doesn’t have a dedicated token, making it a standout option in this crowded market.

4. PoS (Proof of Stake) Verification & Big Stake Earning Opportunities

PoS (Proof of Stake) is a blockchain consensus mechanism that validates transactions and secures the network. Launched as an alternative to the traditional version of the PoW (Proof of Work) mechanism, PoS ensures a fairer distribution of validation power among users. Thus, PoS is essential for facilitating energy-efficient, secure, and decentralized transactions.

Enough information about PoS, let’s return to the main topic.

So, the point is that a large number of cryptocurrencies on BTCpop use the PoS protocol.

This means,

When you deposit your cryptocurrencies on BTCpop, they automatically go into a special pool. This pool helps validate transactions on the blockchain network, and in return, you get the chance to earn more cryptocurrency as a reward.

‘It’s like putting your money in a savings account that earns interest.’

If you want to withdraw your staked coins from the pool, you can also do this. The platform offers top-tier flexibility to access your funds at any time while still earning extra cryptocurrency in the meantime. In total, there are 129 different staking coins at BTCpop.

Given below are some of the top staking coins:

- 2Give

- Abjcoin

- Aerium

- Clams

- Clockcoin

- EverGreenCoin

- GPUcoin

- Espers 2.0

- Iocoin

- Obsidian

- BitBay

- eMark

- Zennies

- TrumpCoin

- Rimbit

- Nexus

- & Many More

Pros & Cons of BTCpop

| Pros | Cons |

| Flexible Loan Options | Limited to BTC Transactions |

| Earning Potential Through Staking | Risk of Default |

| No Middleman Required | Volatility of Cryptocurrency |

| Fast Transaction Processing | Dependency on Internet and Technology |

| Variety of Loan Types | Regulatory Uncertainty |

| User-Friendly Interface |

Fees

In this BTCpop review, let’s clear your queries related to the fees of BTCpop.

The fees of BTCpop largely depend upon the type of service you’re leveraging.

Loans:

No Collateral Loans: 4% of the loan amount

Collateralized Loan with Verification: 2% of the total amount

Collateralized Loan without Verification: 3% of the total amount

Posting loan application: 1%

Late Installments: 2% of the total

Cryptocurrency Exchanges

On Cryptocurrency Trades: 0.25%

Staking

On Staked Coins: 2%

IPOs

Listing an IPO: 1%

Purchasing Shares in an IPO: 1%

Trading of IPOs: 0.7%

Final Thoughts of BTCpop Review: Is this Really an Ideal P2P Crypto Lending Platform?

In conclusion, of this BTCpop review, we would like to say only,

BTCpop is a versatile and user-friendly platform for both borrowers and lenders. Not only can you leverage a variety of loan options, but you can also earn money through staking on this innovative platform. There are two things that make BTCpop an attractive choice.

- First, lack of intermediaries

- Secondly, Fast-transaction processing.

As your ultimate guide, we would also like to highlight its limitation to BTC transactions, coupled with the inherent risks of cryptocurrency volatility and the potential for hacks. This may sound like a big challenge, but the number of scams is low if we look at the data. However, it doesn’t mean you shouldn’t worry if the number of scams is low. Before diving into the platform, thoroughly understand its workings and assess your risk tolerance.

If we talk about now, there’s nothing wrong with saying that it is one of the best P2P crypto lending platforms.

About ‘The Blockchainist’

‘The Blockchainist’ is a premier source for blockchain-related blog posts, offering in-depth coverage of a wide range of topics. From detailed analyses of emerging technologies and practical guides to emerging innovations, ‘The Blockchainist’ is your go-to resource for all things blockchain. Stay informed and ahead of the curve with our expert insights and comprehensive blogs.